Usaa auto insurance this isn't only based on.

When it comes to finding the best auto insurance, USAA is a name that often comes up in conversations. With its long-standing reputation and commitment to serving the military community, USAA has become a popular choice for many drivers. In this post, we will review USAA auto insurance for the year 2022. We'll take a closer look at what makes USAA stand out from the competition and why it might be the right choice for you.

USAA Auto Insurance - Not Just Based on Price

One of the first things you might notice about USAA auto insurance is that it offers more than just competitive prices. While affordability is certainly an important factor when choosing an insurance provider, USAA goes beyond that. They focus on providing exceptional customer service and value to their members.

USAA understands the unique needs and challenges faced by members of the military community. They offer tailored insurance coverage options that cater specifically to military personnel and their families. Whether you're currently serving, a veteran, or a family member of someone in the military, USAA has you covered.

What Sets USAA Apart

USAA's commitment to its members is unparalleled in the industry. They go above and beyond to provide exceptional service and benefits to those who serve our country. Here are some of the key features that set USAA apart from other auto insurance providers:

- Customer Satisfaction: USAA consistently receives high marks for customer satisfaction. Their dedication to meeting the needs of their policyholders is evident in their excellent customer reviews.

- Financial Stability: As a financially strong company, USAA has the resources to fulfill its obligations to policyholders. This gives customers peace of mind, knowing that their claims will be handled promptly and fairly.

- Discounts and Savings: USAA offers various discounts and savings opportunities, making it easier for members to save on their auto insurance premiums. These discounts can include safe driving discounts, good student discounts, and more.

- Convenient Mobile App: USAA's mobile app allows policyholders to manage their insurance policies, file claims, and even request roadside assistance with just a few taps on their smartphones.

These are just a few examples of the benefits you can expect when you choose USAA as your auto insurance provider. The company has consistently proven its commitment to its members and their unique needs.

A Closer Look at USAA's Auto Insurance Coverage

Now that we've explored what sets USAA apart, let's dive deeper into their auto insurance coverage. USAA offers a wide range of coverage options to cater to the specific needs of their members:

- Bodily Injury Liability: This coverage helps pay for the medical expenses of others injured in an accident caused by you or other insured drivers.

- Property Damage Liability: This coverage helps pay for the repairs or replacement of another person's property if it is damaged in an accident caused by you or other insured drivers.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged or totaled in an accident, regardless of fault.

- Comprehensive Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged or stolen due to something other than a collision, such as theft, vandalism, or weather-related incidents.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has insufficient or no insurance.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses, lost wages, and other expenses resulting from an accident, regardless of fault.

- Roadside Assistance: USAA's roadside assistance coverage provides help if you get a flat tire, run out of gas, need a tow, or require other emergency services on the road.

These are just a few examples of the coverage options available through USAA. They understand that no two drivers' needs are the same, which is why they offer customizable coverage options to meet your specific requirements. This ensures that you have the right protection when you need it the most.

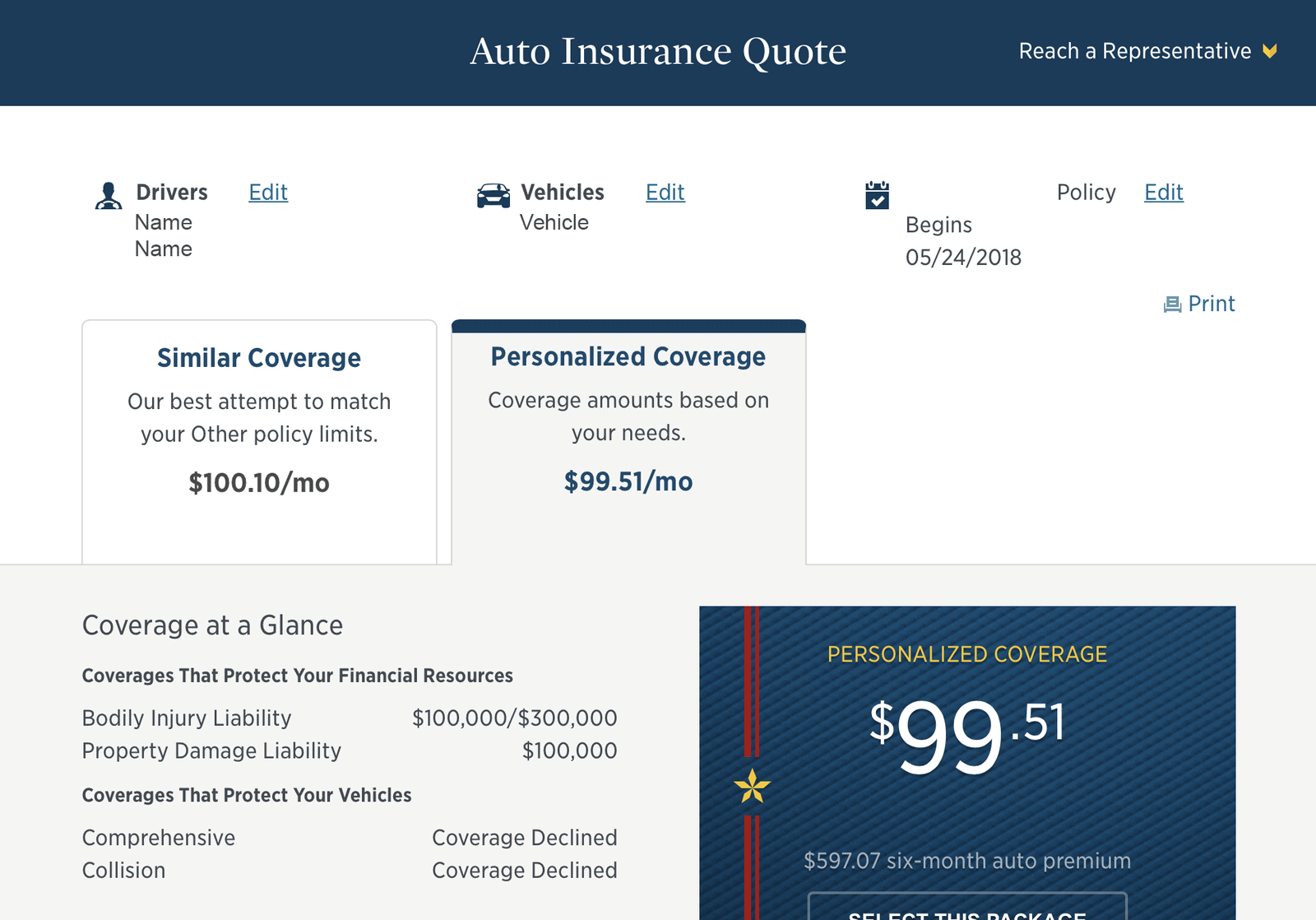

How to Get a USAA Auto Insurance Quote

If you're interested in getting an auto insurance quote from USAA, the process is easy and convenient. You can visit their website or call their toll-free number to get started. The USAA website provides a user-friendly interface that allows you to enter your information and receive a quote within minutes.

When requesting a quote, make sure to provide accurate and up-to-date information about your driving history, vehicle details, and any other relevant information. This will help USAA provide you with an accurate quote that reflects your specific situation.

Once you've received your quote, take the time to review it carefully. Make sure to compare the coverage options, deductibles, and premiums with your current policy or any other quotes you may have received from other insurance providers. This will help you make an informed decision about whether USAA is the right choice for you.

Final Thoughts - Why Choose USAA for Auto Insurance

When it comes to auto insurance, USAA stands out for many reasons. Their commitment to serving the military community, exceptional customer service, and customizability make them an attractive choice for many drivers. If you are a member of the military community or a family member of someone who is, it's worth considering USAA auto insurance.

Remember, auto insurance is not just about finding the most affordable coverage; it's also about finding the right coverage that meets your specific needs. USAA understands this and goes the extra mile to provide tailored insurance options that cater to the unique requirements of military personnel and their families.

So, whether you're a service member, a veteran, or a family member of someone in the military, USAA auto insurance could be the right fit for you. With their exceptional customer service, competitive prices, and dedication to serving the military community, USAA has earned its reputation as one of the leading auto insurance providers in the industry.

Take the time to explore all that USAA has to offer and request a quote to see how their coverage and prices compare to your current policy. You may find that USAA is the perfect fit for your auto insurance needs.

Posting Komentar untuk "Usaa auto insurance this isn't only based on."

Jika ada pertanyaan, silahkan sampaikan via kolom komentar dibawah ini :)