Progressive car insurance review for 2023

Progressive Insurance Agent Tucson

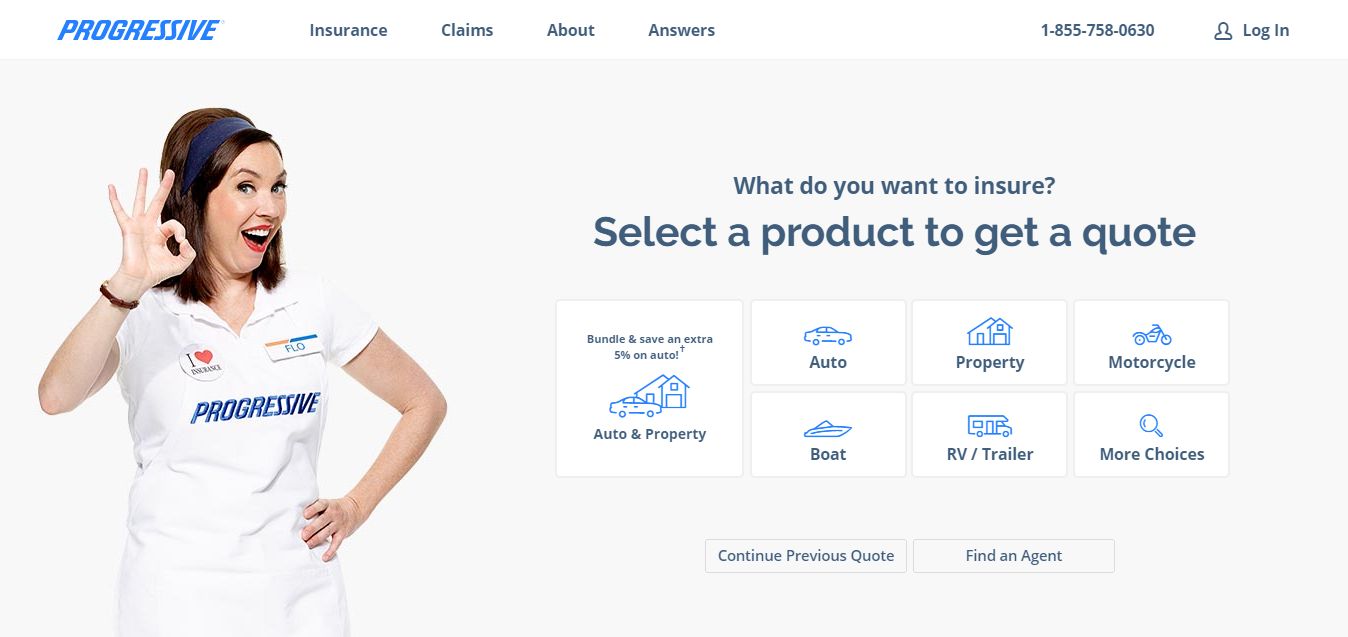

Progressive Insurance

Progressive Insurance has made a strong impact in the insurance market, offering unique and innovative solutions to its customers. As a trusted provider of insurance services, Progressive ensures that their clients receive the best coverage for their needs. With a focus on providing personalized service, Progressive insurance agents in Tucson offer support and guidance to their customers in selecting the right insurance policies.

When it comes to insurance, making the right choice is crucial. Progressive Insurance understands this and implements strategies that have helped them become a leader in the industry. Their comprehensive product offerings cater to various individuals and businesses, ensuring that everyone can find the perfect coverage that suits their needs.

Benefits of Progressive Insurance

Progressive Insurance provides numerous benefits to its customers. From cost-effective policies to top-notch customer service, their commitment to excellence is evident through the quality of their offerings. Let's explore some of the key benefits provided by Progressive Insurance:

1. Wide Range of Insurance Products: Progressive Insurance offers an extensive range of insurance products, including auto insurance, home insurance, renters insurance, and more. This breadth of coverage options ensures that customers can find suitable policies to protect their valuable assets.

2. Competitive Rates: Progressive Insurance strives to provide competitive rates to its customers. They understand that affordability is a crucial factor for many individuals and businesses when choosing an insurance provider. By offering competitive rates, Progressive ensures that its clients can get the coverage they need within their budget.

3. Convenient Online Services: In this digital age, convenience is key. Progressive understands this and offers a user-friendly online platform where customers can easily manage their policies, make payments, and file claims. This digital approach saves time and provides a hassle-free experience for policyholders.

4. Progressive Snapshot: Progressive Insurance goes the extra mile to reward safe driving habits. They offer a program called Progressive Snapshot, which collects data about a customer's driving behaviors. Based on this data, safe drivers can potentially earn discounts on their premiums. This program encourages responsible driving and can lead to significant savings for policyholders.

5. Superior Customer Service: Progressive Insurance is renowned for its exceptional customer service. Their knowledgeable and friendly agents are always ready to assist customers, answering their questions and providing expert guidance. The dedicated support provided by Progressive Insurance staff sets them apart from other insurance providers.

Why Choose Progressive Car Insurance?

When it comes to car insurance, Progressive is a reliable choice for many. They offer comprehensive coverage options that ensure peace of mind for drivers. Here are some reasons why Progressive Car Insurance stands out:

1. Unique Coverage Options: Progressive Car Insurance provides various coverage options tailored to each driver's needs. Whether you are a new driver, have a flawless driving record, or require specialized coverage such as classic car insurance, Progressive has you covered.

2. Affordable Rates: Progressive strives to offer competitive rates without compromising on the quality of coverage. By considering factors such as driving history, vehicle type, and location, Progressive can provide customized quotes that reflect the unique circumstances of each policyholder.

3. Name Your Price® Tool: One of the standout features of Progressive Car Insurance is the Name Your Price® tool. This tool allows customers to set their desired price for coverage and then receive policy options that match that budget. It provides flexibility and transparency, allowing customers to make informed decisions.

4. Network of Repair Shops: Progressive has an extensive network of authorized repair shops, ensuring that customers receive quick and efficient service after an accident. By choosing from these trusted repair facilities, customers can have peace of mind knowing that their vehicles will be handled by experienced professionals.

5. Discounts and Savings: Progressive offers various discounts and savings opportunities to its car insurance customers. These may include multi-policy discounts, safe driver discounts, and discounts for using certain safety features in your vehicle. These cost-saving measures make Progressive Car Insurance an attractive option for many drivers.

How to Make the Right Car Insurance Choice

When it comes to selecting the right car insurance policy, it is important to consider several factors. Here are some key steps to help you make an informed decision:

Step 1: Assess Your Coverage Needs

Start by evaluating your coverage needs. Consider factors such as the value of your vehicle, your driving habits, and the level of risk you are comfortable with. By understanding your needs, you can select coverage options that adequately protect you and your vehicle.

Step 2: Research Different Providers

Research different car insurance providers and compare their offerings. Look for companies with a good reputation, competitive rates, and a range of coverage options. Reading customer reviews can also give you insights into the quality of their customer service.

Step 3: Obtain Multiple Quotes

Obtain quotes from multiple providers to get a sense of the cost and coverage options available. This will help you identify policies that align with your budget and needs. Keep in mind that the cheapest policy may not always provide the most comprehensive coverage.

Step 4: Evaluate Additional Benefits

Consider additional benefits offered by car insurance providers. Some companies may offer perks such as roadside assistance, rental car coverage, or accident forgiveness. Evaluate these benefits and determine whether they add value to your policy.

Step 5: Review the Policy Terms and Conditions

Before finalizing your decision, review the policy terms and conditions carefully. Pay attention to details such as coverage limits, deductibles, and exclusions. Ensure that the policy aligns with your expectations and provides the necessary coverage for your specific needs.

Step 6: Seek Professional Advice

If you are unsure about any aspect of car insurance or need guidance in selecting the right policy, consider seeking advice from a professional insurance agent. They can provide valuable insights and help you make an informed decision that suits your unique circumstances.

In Conclusion

Progressive Insurance, with its commitment to providing personalized service and comprehensive coverage options, is a top choice for individuals and businesses in Tucson. Their competitive rates, convenient online services, and stellar customer support set them apart from other insurance providers. Whether you are seeking auto insurance or other insurance coverages, Progressive Insurance is a trustworthy option to consider.

When choosing car insurance, it is essential to carefully evaluate your needs, research different providers, and consider the benefits and policy terms. By following these steps, you can identify the right car insurance policy that provides the coverage and peace of mind you deserve.

Posting Komentar untuk "Progressive car insurance review for 2023"

Jika ada pertanyaan, silahkan sampaikan via kolom komentar dibawah ini :)